is stock trading taxable in malaysia

Is Stock Trading Taxable In Malaysia Option Trading Course Malaysia - strategi bitcoin profit 99 9 profit Your Guide To Trading Strategies is stock trading taxable in malaysia. There may be entities that operate in Malaysia whose functional currency is other than RM eg.

How To Open A Stock Brokerage Account In Malaysia

In Malaysia only income is subject to tax.

. In Malaysia taxable capital gains are those resulting from the sale and purchase of real estate. Capital gain from stocks investment is not taxable in Malaysia but heres what you do which can cause it to be taxable. Stocks trading online may.

Stock option trading can be pretty intimidating. Generally profits from frequent stock trading aka day trading will be deemed taxable income. However as one reader wrote in most people are of the view that capital gains from stock investing in Malaysia are not taxable a perception that is propagated on the Internet.

Any capital gains on shares are not subject to tax under the. I am currently unemployed and mainly trade stocks forex and options to earn some incomeforesee will continue to do so for the rest of. In Malaysia any sale made from your investments is not subject to the capital gains tax.

Profits from Taxable Shares. Forex income is taxable in Malaysia as income tax but Forex capital gains are exempt from tax. So no matter how much profit you make from your investment it is tax-free.

Stock in trade is anything a business acquires produces or manufactures for the purpose of manufacturing selling at a profit or exchanging. THE government has made a surprising U-turn on Dec 30 2021 after announcing that foreign-sourced income received in Malaysia by Malaysian tax residents will be taxed. Depending on how often you trade shares and how the Inland Revenue Board Of Malaysia IRBM classifies you you might need to pay tax on the profits or gains youve made or you could be.

When investing in shares or stocks investors may focus on investing either for dividend yields or capital gains. Your capital assets are also not subject to this tax system. When is the gain income and when is it capital.

Taxation on Forex trading in Malaysia Forex income is indeed taxable in Malaysia and is seen as income tax. As far as I know there will be no tax if your main source of income is not coming from stock trading. This means that if you trade with a swap-free Islamic account and are held to.

Yes its true one prominent stocks. For tax purposes the value of stock in tradewhich is taken into account in determining the adjusted income is ascertained in accordance with section 35 of the ITA. The first one should be is forex trading taxable in Malaysia.

Under the Malaysian Income Tax Act 1967 the government does not impose a tax on any. Profits from Non-Taxable Shares Income Tax Because they are capital gains stock investment gains are tax-free Capital Gain Tax. The nature of a business has to be established.

In general capital gains in the country. Use a foreign broker. However Forex capital gains are exempt from tax.

What this means is if an. If you invest in forex trading be ready to remit income taxes except for forex capital gains exempted. Is income from stock trading taxable.

Capital gains on shares are not taxed. When you first get into stock trading you wont go too long before you start hearing about puts calls and options. While income is taxable in Malaysia capital gains on shares are not subject to tax.

Forex Tax Free Countries In 2022 Forex Education

Is Stock Trading Taxable In Malaysia Savannagwf

How To Buy Us Stocks In Malaysia Singapore Comparing 7 Brokers Youtube

Stocks Investing Capital Gain Is Taxable In Malaysia If You Do This Youtube

Day Trading In Malaysia 2022 How To Start Markets Strategies

A Guide To Stock Investment In Malaysia Dividend Magic

Day Trading In Malaysia 2022 How To Start Markets Strategies

The Top 5 Stock Brokers In Malaysia 2022

Investing Making It Easier To Invest In Foreign Stocks The Edge Markets

Miles To Go The Future Of Emerging Markets Imf F D

Tax For The 6 Common Investments In Malaysia Smart Investor Malaysia

The Best Capital Gains Free Countries For Forex Trading Business Review

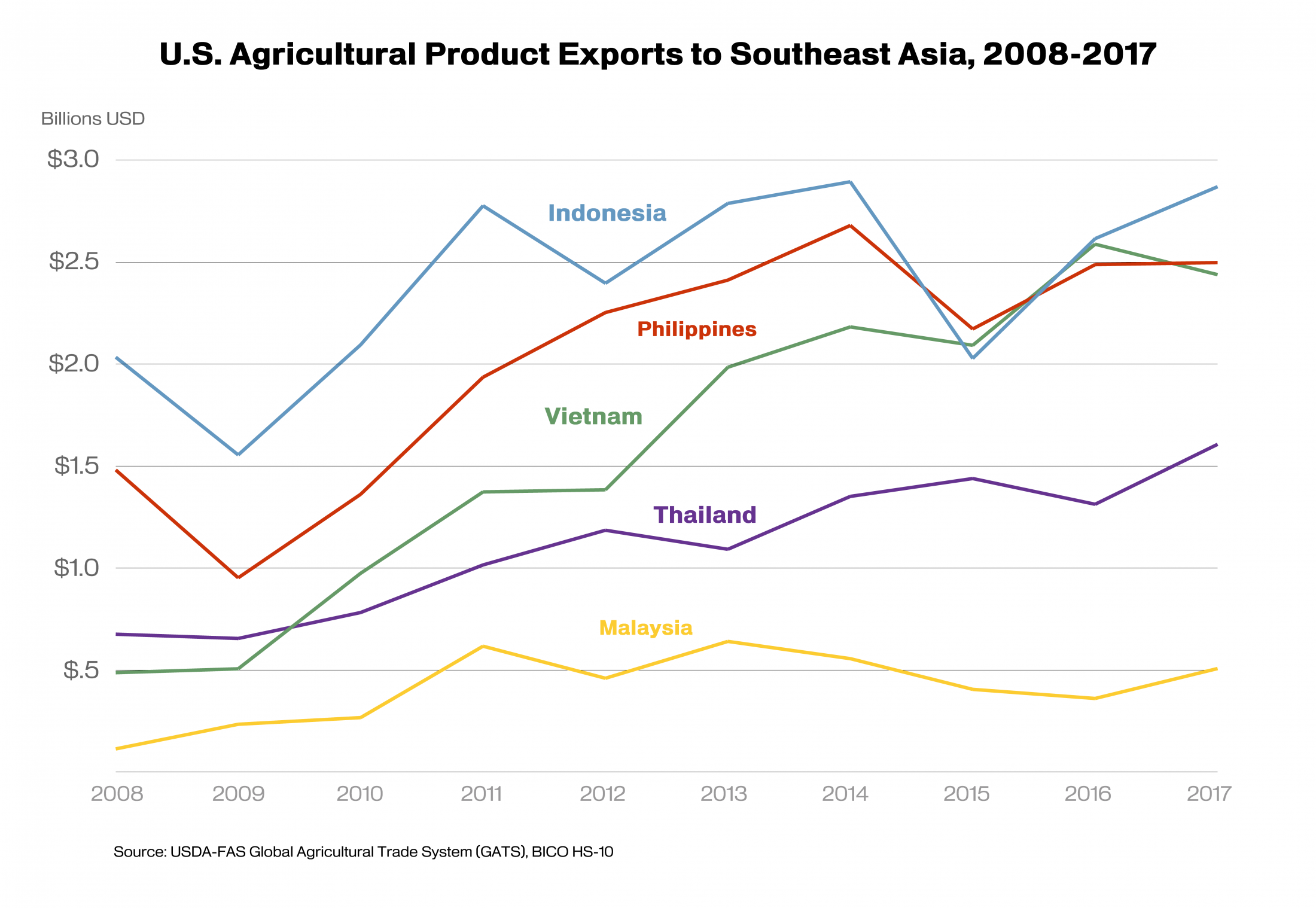

Trade Opportunities In Southeast Asia Indonesia Malaysia And The Philippines Usda Foreign Agricultural Service

The Effect Of Goods And Services Tax Gst Imposition On Stock Market Overreaction And Trading Volume In Malaysia And Australia Semantic Scholar

Financial Transaction Tax Analysis Of A Financial Transactions Tax Ftt

How British Business Can Access China S New 18 Trillion Asia Rcep Free Trade Agreement Via The Back Door

0 Response to "is stock trading taxable in malaysia"

Post a Comment